Machine Learning is making remarkable inroads in the finance industry. Many financial companies are taking advantage of machine learning. So if you are interested to learn machine learning for finance and looking for some good courses, read this full article. In this article, you will find the 8 Best Machine Learning Courses for Finance that will provide good knowledge of machine learning for finance.

- 1. Machine Learning for Finance in Python- DataCamp

- 2. Artificial Intelligence for Trading- Udacity

- 3. Machine Learning for Trading Specialization- Coursera

- 4. Machine Learning and Reinforcement Learning in Finance Specialization- Coursera

- 5. Using Machine Learning in Trading and Finance- Coursera

- 6. Reinforcement Learning for Trading Strategies- Coursera

- 7. Python & Machine Learning for Financial Analysis- Udemy

- 8. Python, Machine Learning and Algorithmic Trading Masterclass- Udemy

Before I discuss Machine Learning Courses for Finance, I would like to tell you- why consider machine learning in finance.

Why Machine Learning in Finance?

Many financial companies are investing in Machine Learning R&D. But…why?. Because of Process Automation, Security, Algorithmic Trading, Robo-advisory, and Underwriting & Credit Scoring. Machine Learning permits companies to optimize costs, enhance customer experience, and expand service.

Process Automation is the most common application of machine learning in Finance. JPMorgan Chase inaugurates a Contract Intelligence (COiN) platform that supports Natural Language Processing. The method operates legal documents and draws out important data from them.

If the same task is done manually, it would take 360,000 labor hours to review 12,000 annual commercial credit agreements. But by using machine learning, it would take just a few hours to review the same number.

There are several other use cases of machine learning in finance. But this article is about Machine Learning Courses for Finance, so let’s move to the courses-

Best Machine Learning Courses for Finance

I have filtered these courses on the following criteria-

Criteria-

- Rating of these Courses.

- Coverage of Topics.

- Engaging trainer and Interesting lectures.

- Number of Students Benefitted.

- Good Reviews from various aggregators and forums.

So, without further ado, let’s start finding Best Machine Learning Courses for Finance.

1. Machine Learning for Finance in Python– DataCamp

Time to Complete- 4 hours

This is an interactive course offered by DataCamp. The instructor of this course is Nathan George (Assistant Professor of Data Science at Regis University).

In this course, you will learn about time-series data and learn how to use different machine learning algorithms (linear model, decision trees, random forests, and neural networks) to predict the future price of stocks in the US markets.

This course will also teach you how to evaluate the performance of the various models.

There are 4 chapters in this course-

- Preparing data and a linear model

- Machine learning tree methods

- Neural networks and KNN

- Machine learning with modern portfolio theory

Who Should Enroll?

- Those are Python Programmer and has basic knowledge of Supervised Learning with scikit-learn.

Interested to Enroll?

If yes, then check out all details here- Machine Learning for Finance in Python

2. Artificial Intelligence for Trading– Udacity

Provider- Udacity

Rating- 4.6/5

Time to Complete- 6 Months (If you spend 10 hrs/week)

This is a Nano-Degree Program for those who want to implement AI in the Stock market. In this program, you will learn the basics of quantitative analysis, including data processing, trading signal generation, and portfolio management.

After enrolling in this Nano-Degree Program, you will use Python to work with historical stock data, develop trading strategies, and construct a multi-factor model with optimization.

There are 8 courses in this Nano Degree Program. Let’s see the details of the courses-

Courses List-

- Basic Quantitative Trading

- Advanced Quantitative Trading

- Stocks, Indices, and ETFs

- Factor Investing and Alpha Research

- Sentiment Analysis with Natural Language Processing

- Advanced Natural Language Processing with Deep Learning

- Combining Multiple Signals

- Simulating Trades with Historical Data

Extra Benefits-

- You will get a chance to work on Real-world projects with Industry Experts.

- You will get Technical mentor support.

- Along with this, you will get a personal coach & career services.

Who Should Enroll?

- Those who have some experience in programming with Python, and be familiar with statistics, linear algebra, and calculus.

Interested to Enroll?

If yes, then check out all details here- Artificial Intelligence for Trading

3. Machine Learning for Trading Specialization– Coursera

Rating- 3.9/5

Provider- New York Institute of Finance & Google Cloud

Time to Complete- 3 months ( If you spend 4 hours per week)

This is a specialization program offered by Coursera. This specialization will teach you how to construct effective trading strategies using Machine Learning (ML) and Python.

After completing this specialization program, you will know how to use the capabilities of Google Cloud to develop and deploy serverless, scalable, deep learning, and reinforcement learning models to create trading strategies.

This specialization program has 3 courses-

- Introduction to Trading, Machine Learning & GCP

- Using Machine Learning in Trading and Finance

- Reinforcement Learning for Trading Strategies

Now, let’s see what will you learn in this program-

What You’ll Learn-

- Basic concepts of Trading, Machine Learning, and Google Cloud Platform.

- Reinforcement learning basics

- Reinforcement Learning Trading Algorithm Optimization.

- Trading

- Reinforcement Learning Trading Strategy Development

- Reinforcement Learning Trading Algo Development

- Finance

- Investment

Extra Benefits-

- You will get a Shareable Certificate and Course Certificates upon completion.

- Along with that, you will get Course Videos & Readings, Practice Quizzes, Graded Assignments with Peer Feedback, Graded Quizzes with Feedback, Graded Programming Assignments.

Who Should Enroll?

- Those who have basic knowledge in Python programming and familiarity with the Scikit Learn, Statsmodels, and Pandas library.

- And those who have a background in statistics and foundational knowledge of financial markets.

Interested to Enroll?

If yes, then check out all details here- Machine Learning for Trading Specialization

4. Machine Learning and Reinforcement Learning in Finance Specialization– Coursera

Rating- 3.7/5

Provider- New York University

Time to Complete- 4 months (If you spend 5 hours per week)

This is another specialization program by Coursera. This specialization will provide essential knowledge to build a strong foundation on core paradigms and algorithms of machine learning for solving financial problems.

After successfully completing this specialization, you will be familiar with famous approaches to modeling market frictions.

This specialization program has 4 courses-

- Guided Tour of Machine Learning in Finance

- Fundamentals of Machine Learning in Finance

- Reinforcement Learning in Finance

- Overview of Advanced Methods of Reinforcement Learning in Finance

Now, let’s see what will you learn in this program-

What You’ll Learn-

- Predictive Modelling

- Financial Engineering

- Machine Learning

- Tensorflow

- Reinforcement Learning

- Option pricing and risk management

- A simple model for market dynamics

- Q-learning using financial problems

- Optimal trading

- Portfolio Optimization

Extra Benefits-

- You will get a Shareable Certificate and Course Certificates upon completion.

- Along with that, you will get Course Videos & Readings, Practice Quizzes, Graded Assignments with Peer Feedback, Graded Quizzes with Feedback, Graded Programming Assignments.

Who Should Enroll?

- Those who know basic math ( calculus, linear algebra, basic probability theory, and statistics) and have basic programming skills in Python.

Interested to Enroll?

If yes, then check out all details here- Machine Learning and Reinforcement Learning in Finance Specialization

5. Using Machine Learning in Trading and Finance– Coursera

Rating- 3.9/5

Provider- New York Institute of Finance & Google Cloud

Time to Complete- 19 Hours

This course is part of Machine Learning for Trading Specialization. In this course, you will learn how to develop advanced trading strategies using machine learning techniques.

You will learn various trading strategies like quantitative trading, pairs trading, and momentum trading.

Along with this, you will also learn how to build machine learning models using Keras and TensorFlow. Now, let’s see the syllabus of the course-

Syllabus of the Course-

- Introduction to Quantitative Trading and TensorFlow

- Introduction to TensorFlow

- Training neural networks with Tensorflow 2 and Keras

- Build a Momentum-based Trading System

- Build a Pair Trading Strategy Prediction Model

Extra Benefits-

- You will get a Course Certificates upon completion.

- Along with that, you will get Course Videos & Readings, Practice Quizzes, Graded Assignments with Peer Feedback, Graded Quizzes with Feedback, Graded Programming Assignments.

Who Should Enroll?

- Those who have Python knowledge and familiar with the Scikit Learn, Statsmodels, and Pandas library.

- And those who are familiar with statistics and the financial market.

Interested to Enroll?

If yes, then check out all details here- Using Machine Learning in Trading and Finance

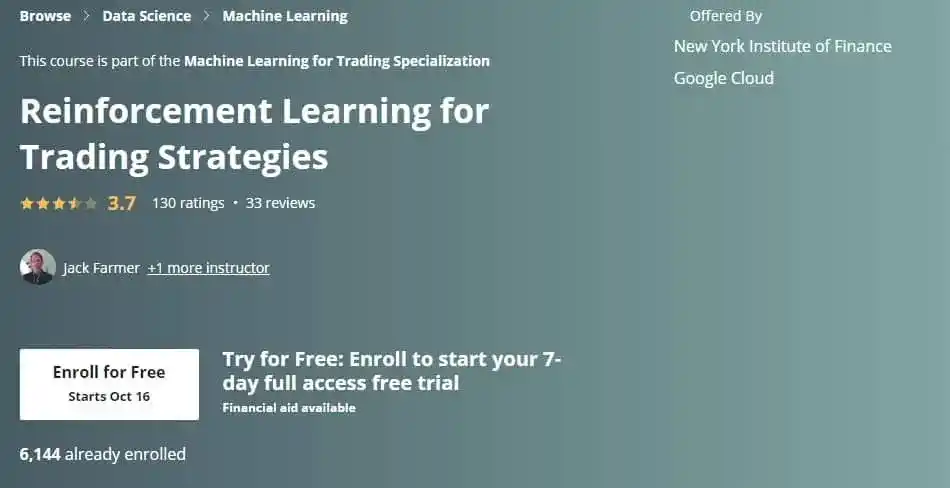

6. Reinforcement Learning for Trading Strategies– Coursera

Rating- 3.7/5

Provider- New York Institute of Finance & Google Cloud

Time to Complete- 12 hours

This course is also part of Machine Learning for Trading Specialization. In this course, you will learn the advantages of using reinforcement learning in trading strategies.

This course will teach you how to build trading strategies using reinforcement learning, how to differentiate between actor-based policies and value-based policies, and how to incorporate reinforcement learning into a momentum trading strategy.

Now, let’s see the syllabus of the course-

Syllabus of the Course-

- Introduction to Course and Reinforcement Learning

- Neural Network Based Reinforcement Learning

- Portfolio Optimization

Extra Benefits-

- You will get a Course Certificates upon completion.

- Along with that, you will get Course Videos & Readings, Practice Quizzes, Graded Assignments with Peer Feedback, Graded Quizzes with Feedback, Graded Programming Assignments.

Who Should Enroll?

- Those who have advanced knowledge in Python Programming and familiar with basic concepts in Machine Learning and Financial Markets.

Interested to Enroll?

If yes, then check out all details here- Reinforcement Learning for Trading Strategies

7. Python & Machine Learning for Financial Analysis– Udemy

Rating- 4.6/5

Time to Complete- 23 hours

Provider- SuperDataScience Team

This course is based on python and teaches you how to solve real-world problems in finance by using Python.

The course starts with python programming concepts, then teaches you python for financial analysis, and in the end, it covers how to perform stock price predictions by using machine learning algorithms.

In this course, you will learn about Deep Neural Networks such as Long Short Term Memory (LSTM) networks, K-Means Clustering, Principal Components Analysis, and Natural Language Processing (NLP) to perform stocks sentiment analysis.

Extra Benefits-

- You will get a Course Certificates upon completion.

- Besides this, you will get full lifetime access to the course material and 15 downloadable resources.

Who Should Enroll?

- There is no prerequisite for this course. Anyone who want to learn machine learning for finance can enroll in this course.

Interested to Enroll?

If yes, then check out all details here- Python & Machine Learning for Financial Analysis

8. Python, Machine Learning and Algorithmic Trading Masterclass– Udemy

Rating- 4.4/5

Time to Complete- 20 hours

Provider- Mammoth Interactive

This course will teach you finance and algorithmic trading by using Python. At the beginning of the course, you will learn about python programming concepts, and later on, you will learn about machine learning and Quantopian.

As the course claim that they will teach python concepts too, but to understand the entire concepts, some previous python knowledge is good to have.

Extra Benefits-

- You will get a Course Certificates upon completion.

- Besides this, you will get full lifetime access to the course material and 19 downloadable resources.

Who Should Enroll?

- Those who have some prior knowledge in Python and willing to specialize in finance.

Interested to Enroll?

If yes, then check out all details here- Python, Machine Learning and Algorithmic Trading Masterclass

And that’s all…So, these are the Best Machine Learning Courses for Finance. Now, it’s time to wrap up.

Conclusion

I hope these listed courses will help you to learn Machine Learning for finance. My aim is to provide you the best resources for Learning. If you have any doubts or questions, feel free to ask me in the comment section.

Tell me in the comment section, which course you like.

All the Best!

Happy Learning!

FAQ

Some most popular use cases of machine learning in finance are Process Automation, Security, Algorithmic Trading, Robo-advisory, and Underwriting & Credit Scoring.

Python is broadly used in finance, especially in quantitative finance. Python is one of the most famous programming languages for Fintech Companies. The HackerRank 2018 Developer Skills Report said that Python was among the top three most popular languages in financial services.

On the report of HackerRank, Python, Java, C++, C#, C, and Ruby are the six best programming languages for FinTech and finance.

Similar Searches

9 Best Tensorflow Courses & Certifications Online- Discover the Best One!

Machine Learning Engineer Career Path: Step by Step Complete Guide

Best Online Courses On Machine Learning You Must Know in 2025

What is Machine Learning? Clear your all doubts easily.

K Fold Cross-Validation in Machine Learning? How does K Fold Work?

What is Principal Component Analysis in ML? Complete Guide!

Linear Discriminant Analysis Python: Complete and Easy Guide

Types of Machine Learning, You Should Know

Multi-Armed Bandit Problem- Quick and Super Easy Explanation!

Upper Confidence Bound Reinforcement Learning- Super Easy Guide

Top 5 Robust Machine Learning Algorithms

Support Vector Machine(SVM)

Decision Tree Classification

Random Forest Classification

K-Means Clustering

Hierarchical Clustering

ML vs AI vs Data Science vs Deep Learning

Increase Your Earnings by Top 4 ML Jobs

How do I learn Machine Learning?

Multiple Linear Regression: Everything You Need to Know About

Thank YOU!

Learn Machine Learning A to Z Basics

Though of the Day…

‘ Anyone who stops learning is old, whether at twenty or eighty. Anyone who keeps learning stays young.

– Henry Ford

Written By Aqsa Zafar

Founder of MLTUT, Machine Learning Ph.D. scholar at Dayananda Sagar University. Research on social media depression detection. Create tutorials on ML and data science for diverse applications. Passionate about sharing knowledge through website and social media.